Although the United States is no longer seen as a global manufacturing hotspot, it continues to hold a strong and distinctive position in high-end belt manufacturing, particularly in premium leather selection, craftsmanship standards, and brand credibility. For fashion and lifestyle brands, “Made in USA” still carries weight—signaling quality, compliance, and authenticity in competitive global markets.

This guide is designed to answer one practical question: how to identify reliable belt manufacturers in the United States. It is tailored for fashion brand founders, sourcing and procurement managers, and private label buyers evaluating production options. The key takeaway is clear—U.S. manufacturing is not limited to luxury brands only, but represents a strategic supply-chain choice for quality control, smaller batch production, and long-term brand positioning.

Overview of the U.S. Belt Manufacturing Landscape

The U.S. belt manufacturing landscape is shaped by three core strengths: craftsmanship, regulatory compliance, and brand value. While the country is no longer a mass-manufacturing hub, American belt makers excel in controlled production, premium materials, and consistent quality standards. This makes U.S. manufacturing especially attractive for brands that prioritize reliability, traceability, and long-term positioning rather than lowest cost.

From a product perspective, the market can be divided into industrial belts and fashion/leather waist belts. Industrial belts—such as conveyor belts, V-belts, and power-transmission belts—represent a multi-billion-dollar sector tied to logistics, mining, agriculture, and manufacturing. In contrast, fashion and leather waist belts form a smaller but more design-driven niche within the broader leather goods category. Within this niche, manufacturers further segment into luxury, fashion, and workwear: luxury belts emphasize materials and handcraft, fashion belts focus on trends and speed, while workwear belts prioritize durability and function.

“Made in USA” continues to command a price premium in global markets, particularly in North America, Europe, and parts of Asia, where it signals quality, ethical labor, and compliance. Another unique feature of the U.S. market is demand for plus-size belts. Due to a higher proportion of larger-body consumers, extended-length belts are not a marginal add-on but a meaningful growth segment, requiring specific pattern design, reinforced materials, and clearer sizing standards.

Overall, the U.S. belt supply chain is characterized by small batch sizes, higher unit prices, and strong specialization, making it a strategic choice rather than a default manufacturing option.

What Defines a Luxury Belt Manufacturer in the USA

A luxury belt manufacturer in the United States is defined less by scale and more by material integrity, craftsmanship depth, and quality discipline. The first marker is leather sourcing. Premium U.S. manufacturers typically work with American hides for their durability and consistency, while also importing Italian and French leathers prized for refined grain, supple handfeel, and superior tanning techniques. The ability to select and control leather at this level directly determines the belt’s aging behavior and long-term appearance.

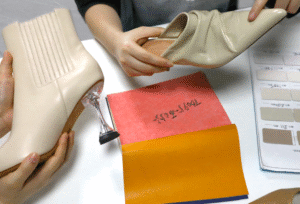

The second defining factor is handcrafted production. Unlike mass-produced belts, luxury manufacturers rely heavily on skilled artisans for manual cutting, edge finishing, and stitching. For example, in high-end production models such as K shoes luxury belt manufacturing solutions, belts are fully handcrafted rather than die-cut, allowing precise control over leather grain direction, thickness consistency, and edge symmetry. Hand-painted or burnished edges, tight stitch spacing, and reinforced stress points are all indicators of true luxury workmanship.

Hardware quality is another critical benchmark. Luxury U.S. belt makers use buckles and metal components that meet strict standards for anti-peeling coatings, scratch resistance, and corrosion durability. Custom hardware molds and engraved logos are common, ensuring brand differentiation while maintaining long-term wear performance.

Finally, luxury manufacturers emphasize AQL-based quality control, not just visual inspection. This includes checks for size accuracy, hole alignment, stitching strength, coating adhesion, and packaging protection. The focus is on functional durability and consistency, ensuring each belt performs as a premium product—not just looks like one at first glance.

Top 8 Belt Manufacturers In USA, For Your Reference

Below are outstanding belt manufacturers in the USA, identified through a combination of data research and direct industry communication. The list is not ranked in any particular order and is provided for reference only, aiming to help brands and buyers better understand reliable options within the U.S. belt manufacturing landscape.

Torino Leather Company

| Item | Details |

|---|---|

| Company Background | Torino Leather Company is a premium U.S. belt and accessories manufacturer known for handcrafted production and extensive use of exotic leathers. The brand positions itself at the high end of the American leather goods market, combining traditional craftsmanship with luxury materials. |

| Company Location | New Orleans, Louisiana, USA |

| Core Product Range | Men’s and women’s belts; exotic leathers (alligator, crocodile, ostrich), calfskin, premium smooth leathers |

| Target Clients | Luxury brands, high-end retailers, bespoke and made-to-measure clients |

| MOQ / Customization / Lead Time | MOQ typically higher due to exotic materials; high level of customization available; estimated lead time 6–10 weeks |

| OEM / ODM / Private Label | OEM: Yes · ODM: Limited · Private Label: Yes |

Tanner Goods

| Item | Details |

|---|---|

| Company Background | Tanner Goods began as a small workshop in Portland and has grown into a respected American leather goods brand. It is known for minimalist aesthetics, durability, and vegetable-tanned leathers, with production remaining largely domestic. |

| Company Location | Portland, Oregon, USA |

| Core Product Range | Primarily men’s belts; vegetable-tanned leather, Horween leather |

| Target Clients | Fashion labels, lifestyle brands, direct-to-consumer buyers |

| MOQ / Customization / Lead Time | Small-batch production possible; limited customization; lead time approximately 4–8 weeks |

| OEM / ODM / Private Label | OEM: Limited · ODM: No · Private Label: Very limited |

Coronado Leather

| Item | Details |

|---|---|

| Company Background | Coronado Leather is a long-established American leather goods brand with a strong focus on heritage craftsmanship and U.S.-sourced materials. Its products emphasize durability and classic styling. |

| Company Location | San Diego, California, USA |

| Core Product Range | Men’s and women’s belts; American bison leather, Horween leather |

| Target Clients | Premium casual brands, heritage and Americana-style labels |

| MOQ / Customization / Lead Time | Medium MOQ; partial customization available; typical lead time 6–8 weeks |

| OEM / ODM / Private Label | OEM: Yes · ODM: Limited · Private Label: Yes |

Barrons-Hunter

| Item | Details |

|---|---|

| Company Background | Founded in 1986, Barrons-Hunter specializes in functional and traditional leather and fabric accessories. The company has strong roots in uniform, military-style, and heritage-inspired products. |

| Company Location | Virginia, USA |

| Core Product Range | Men’s belts; leather belts, fabric belts, ribbon and grosgrain belts |

| Target Clients | Uniform suppliers, niche retailers, lifestyle brands |

| MOQ / Customization / Lead Time | Flexible MOQ; good material and construction customization; lead time around 4–6 weeks |

| OEM / ODM / Private Label | OEM: Yes · ODM: Limited · Private Label: Yes |

NYC Belts (Universal Elliot Corp)

| Item | Details |

|---|---|

| Company Background | Universal Elliot Corp operates NYC Belts and has over 30 years of experience as a custom belt and accessories manufacturer. It is strongly B2B-oriented and supports fashion brands and private labels. |

| Company Location | New York City, USA |

| Core Product Range | Men’s and women’s belts; leather belts, fabric belts, mixed-material designs |

| Target Clients | Fashion labels, private label brands, designers |

| MOQ / Customization / Lead Time | Low to medium MOQ; strong customization capability; lead time typically 4–6 weeks |

| OEM / ODM / Private Label | OEM: Yes · ODM: Yes · Private Label: Yes |

Hanks Belts

| Item | Details |

|---|---|

| Company Background | Hanks Belts is a U.S. brand focused on rugged, long-lasting men’s leather belts, often marketed with lifetime durability claims. Production is vertically integrated and brand-controlled. |

| Company Location | Montana, USA |

| Core Product Range | Men’s belts; full-grain leather, suede |

| Target Clients | Direct consumers, workwear-focused buyers |

| MOQ / Customization / Lead Time | Primarily own-brand production; minimal customization; stable lead times |

| OEM / ODM / Private Label | OEM: No · ODM: No · Private Label: No |

Zilker Belts

| Item | Details |

|---|---|

| Company Background | Zilker Belts blends Texas-inspired style with South American craftsmanship, offering hand-crafted belts that emphasize design and artisanal character. |

| Company Location | Austin, Texas, USA |

| Core Product Range | Men’s and women’s belts; leather belts, woven and mixed-material styles |

| Target Clients | Fashion-forward brands, lifestyle labels |

| MOQ / Customization / Lead Time | Small-batch friendly; design customization available; lead time 4–8 weeks |

| OEM / ODM / Private Label | OEM: Limited · ODM: Limited · Private Label: Limited |

The Belted Cow Company

| Item | Details |

|---|---|

| Company Background | The Belted Cow Company produces handcrafted belts inspired by New England tradition with a modern, playful design approach. The brand emphasizes craftsmanship and distinctive styling. |

| Company Location | New England, USA |

| Core Product Range | Men’s and women’s belts; leather belts, textile and novelty styles |

| Target Clients | Fashion and lifestyle brands, specialty retailers |

| MOQ / Customization / Lead Time | Low MOQ; limited customization; lead time around 4–6 weeks |

| OEM / ODM / Private Label | OEM: Limited · ODM: No · Private Label: Limited |

OEM, ODM & Private Label Capabilities Explained in U.S. Belt Factories

In the U.S. belt manufacturing ecosystem, OEM, ODM, and Private Label represent three distinct collaboration models, each suited to different brand stages and business goals. OEM (Original Equipment Manufacturing) refers to production strictly based on the buyer’s existing designs, technical drawings, and material specifications. This model is ideal for established brands that already have clear design language, tested patterns, and supply-chain experience, and simply require a reliable factory to execute production with consistent quality.

ODM (Original Design Manufacturing) goes one step further by involving the manufacturer in the design process. U.S. belt factories offering ODM typically assist with leather selection, pattern optimization, hardware sourcing, and fit adjustments. This model is especially suitable for emerging or new fashion brands that need design and engineering support but still want strong control over brand identity and aesthetics.

Private Label manufacturing focuses on branding and customization rather than product engineering. It is often the fastest route to market, allowing brands to apply their logos, packaging, and hardware variations to proven belt designs. For many lifestyle and retail-focused labels, private label acts as a strategic entry point before moving into full OEM or ODM development.

A key advantage of U.S. belt factories lies in small-batch customization, where production runs can start at relatively low quantities with high quality control. However, this comes with higher unit costs and longer lead times. For luxury and high-end fashion brands, the product’s higher price premium often justifies working with small bespoke workshops in the U.S., where craftsmanship, exclusivity, and brand storytelling outweigh scale efficiency.

Cost Structure & MOQ Expectations in the U.S. Belt Supply Chain

The cost structure of belt manufacturing in the United States is driven primarily by materials, labor, hardware, and packaging. Leather is the largest cost component, especially when using premium American hides or imported Italian and French leathers. Labor costs are significantly higher than in Asia, reflecting skilled craftsmanship, compliance with labor regulations, and smaller production teams. Hardware, including buckles and metal components, adds further cost when anti-scratch coatings, corrosion resistance, or custom molds are required. Packaging—often overlooked—also contributes, particularly for brands demanding retail-ready boxes, dust bags, or sustainable materials.

When comparing U.S. manufacturing to Asian production, the price gap is clear. A leather belt produced in the U.S. may cost 2–4 times more per unit than a comparable product made in China, Vietnam, or India. However, this difference reflects not only labor but also lower MOQs, higher quality control, and stronger brand signaling through “Made in USA.”

Typical MOQ expectations in the U.S. belt supply chain range from 50 to 300 pieces per style, depending on leather type, hardware complexity, and customization level. Small workshops often support lower MOQs, while larger factories require higher commitments.

In terms of brand stage, U.S. manufacturing suits early-stage brands testing market response with limited runs and premium positioning, as well as mature brands seeking consistent quality, supply-chain transparency, or localized production. It is less suitable for price-driven mass-market strategies but highly effective as a strategic manufacturing choice for quality-led brands.

Common Challenges When Working with U.S. Belt Manufacturers

Working with U.S. belt manufacturers offers quality and reliability, but it also comes with distinct challenges that brands must understand in advance. One of the most common trade-offs is longer lead times versus higher stability. U.S. factories typically operate with smaller teams and handcrafted processes, which means production cycles are slower than mass manufacturing in Asia. However, schedules tend to be more predictable, with fewer last-minute changes, quality failures, or shipment delays.

A frequent misconception appears among cost-sensitive brands. Many first-time buyers approach U.S. manufacturers expecting pricing flexibility similar to overseas factories. In reality, U.S. production is not optimized for low-margin, high-volume orders. Brands that focus primarily on price rather than positioning often find American manufacturing misaligned with their business model.

Another key challenge is communication efficiency and technical clarity. U.S. manufacturers rely heavily on accurate documentation rather than informal instructions. A well-prepared belt tech pack—including dimensions, leather thickness, edge finish, stitch type, hole spacing, buckle specs, and tolerances—is essential. Incomplete or vague specifications almost always result in delays, revisions, or cost increases.

Finally, brands must avoid over-customization, a common pitfall in small-batch production. Custom hardware, unique leather finishes, special packaging, and non-standard sizing can quickly escalate costs when applied simultaneously. A disciplined approach—prioritizing one or two high-impact custom elements while standardizing the rest—helps control budgets and timelines. Successful collaborations with U.S. belt manufacturers depend on realistic expectations, clear documentation, and strategic design restraint.

How to Choose the Right U.S. Belt Manufacturer for Your Brand

Choosing the right U.S. belt manufacturer begins by working backward from your brand positioning. Luxury and premium fashion brands typically require small-batch production, refined craftsmanship, and strong brand storytelling, which aligns well with U.S.-based specialty workshops. By contrast, mid-market or price-driven brands often prioritize scalability and cost efficiency, making overseas OEM production a more suitable option. Clarifying whether your brand competes on quality, image, or price is the foundation of the decision.

A critical question is when to choose U.S. manufacturing versus overseas OEM. U.S. factories are especially well-suited for high-end, limited-run, or made-to-order brands, where country of origin contributes directly to brand perception and pricing power. Many luxury and fashion labels also work with hybrid models—using U.S. production for flagship or custom lines while relying on overseas OEM for volume-driven collections. In this context, partners such as The K Family Team, which offers private label belt solutions for luxury and fashion brands, can bridge design, sourcing, and brand execution across different manufacturing regions.

Before scaling, brands should adopt a sample testing and small pilot production strategy. Initial samples and low-quantity trial orders help verify leather quality, craftsmanship consistency, sizing accuracy, and communication efficiency, reducing long-term risk.

Finally, brands must weigh long-term partnerships versus single-project sourcing. Long-term collaboration enables better alignment, smoother development cycles, and more stable quality control. One-off projects may offer flexibility, but strategic growth is best supported by manufacturers—and solution partners—that understand the brand’s evolving needs and positioning.

FAQs

Yes, especially for startups targeting the premium or luxury segment. U.S. manufacturers often support small-batch production, allowing new brands to test the market with limited quantities while maintaining high quality and strong brand positioning.

Most U.S. luxury belt manufacturers set MOQs between 50 and 300 pieces per style, depending on leather type, hardware complexity, and customization level. Small artisan workshops may accept even lower quantities.

Yes. Many U.S. factories offer custom buckles, logo engraving, and proprietary hardware molds, although tooling costs and lead times may be higher compared to standard components.

For premium and luxury brands, “Made in USA” carries strong value in global markets, signaling quality, compliance, and authenticity—particularly in North America, Europe, and parts of Asia.

Typical production lead times range from 4 to 10 weeks, depending on order size, customization, and material availability.

![5wedges[1]](https://k.shoes/wp-content/uploads/2021/07/5wedges1-300x87.jpg)